Land Tax Sale St Louis

Minnesota statute chapter 282 gives the county board the county auditor and the land minerals department authority over the management and sale of tax forfeited lands.

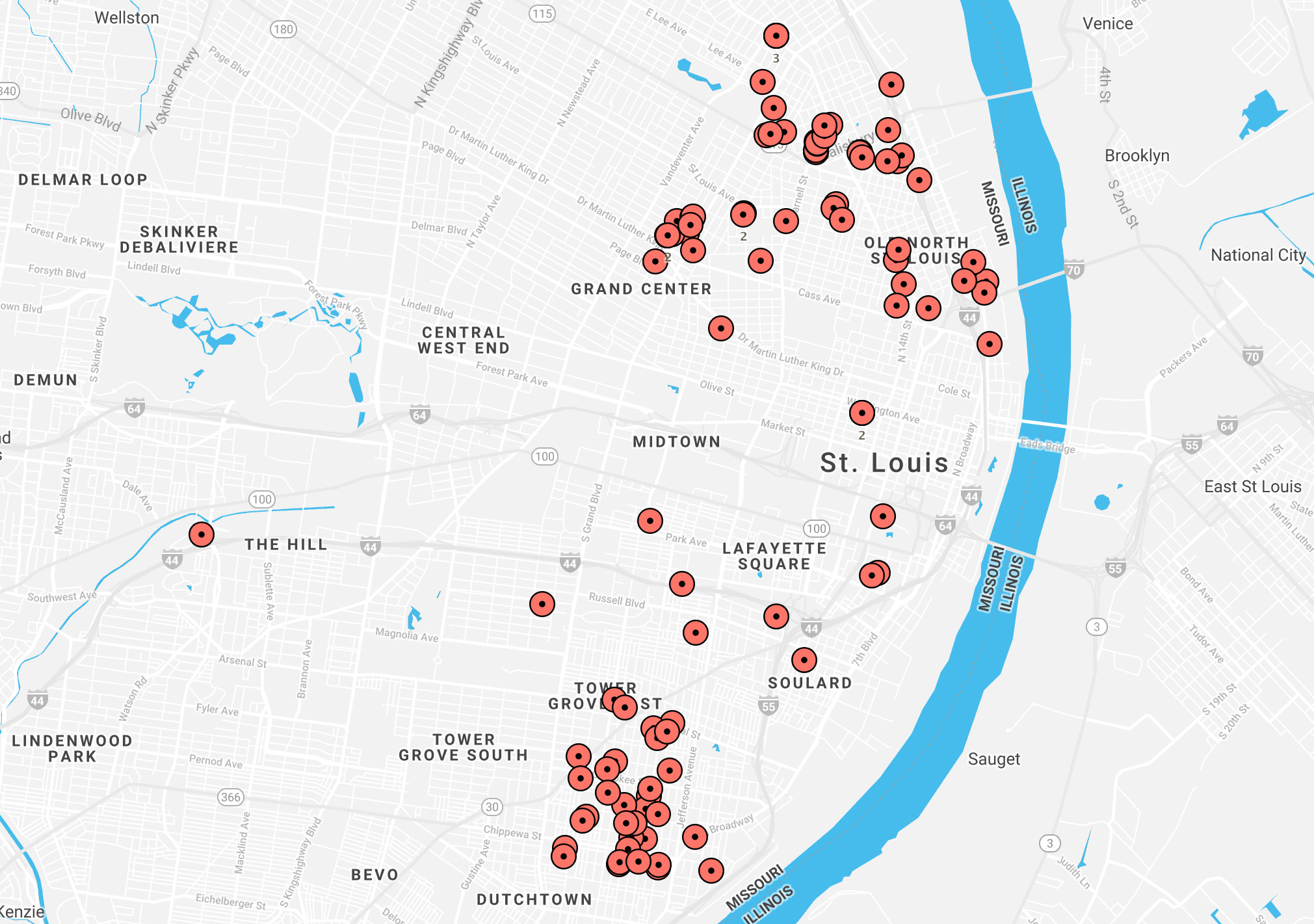

Land tax sale st louis. What happens when you buy a tax lien. July 21 2020 sale 202. On november 1 2011 the st. Saint louis mo tax liens and foreclosure homes.

Normally the sheriff s office holds land tax sales five times a year. Land tax sales 201 and 202 will be held on 11th street behind the civil courts building masks are required. 10 acres near much federal land. The land minerals department manages just under 900 000 acres of tax forfeit rural land and 13 000 urban parcels.

Louis daily record published by missouri lawyers media. Civil courts building 10 north tucker blvd 4th floor st. A list of land for potential sale is prepared by the land minerals department and submitted for county board approval. Revised sales date for 2020.

559 november 1 2011 the current leaseholder has the first right to purchase the land at market value or to continue the annual lease not to exceed the lifetime of the leaseholder. Louis county is land that has forfeited to and is now owned by the state of minnesota for the non payment of taxes. If no one buys the property at the first second or third tax sale but it does sell at a subsequent offering you don t get a redemption period. Hundreds attended the land tax sale on the steps of the civil courts building in downtown st.

Properties will be posted 2 weeks prior to sale dates. City hall 1200 market street room 110 st. Louis on tuesday july 21 2020. 314 622 4413 email addresses mon fri.

Parcels vary in size from a few square feet to 100 s of acres. August 18 2020 sale 204. October 6 2020 sale 205. No right to redeem after a subsequent sale.

Tax forfeited land sales tax forfeited land managed and offered for sale by st. Are you looking to buy a tax lien in saint louis mo. Louis mo 63103 phone. Sales are held at 9 00 am at.

As of october 5 saint louis mo currently has 9 167 tax liens available. When a home sells at a third tax sale you get 90 days to redeem the home. Home buyers and investors buy the liens in saint louis mo at a tax lien auction or online auction.